Formally,

the dividend yield is equal to the ratio between

the annual dividend per share and the price per share. For example, if

the price per share is $100, the stock is paying quarterly $1 of

dividends per share and the dividend payments are not

reinvested in the stock, the annual dividend per share and

dividend yield would be equal to $4 and 4%, respectively.

Sometimes

secure, stable and low-growth companies distribute a portion of their

earnings to some of their share holders because they do not have to

reinvest them to sustain growth. These are known as

dividends

and are usually quoted in terms of the dollar amount each share

receives. When trading foreign currency, there exists an interest rate

paid per unit of the currency lent or borrowed, analogous to the

riskless

interest rate,

r, considered in the

binomial

model. This interest rate can be considered as a

dividend

yield (see tangent). In this lesson we will explore how the

previously developed theory changes when the risky asset in the market

has dividend payments. For simplicity, the examples presented below are

one-step models, however, the results easily extend to the multi-period

case.

Example:

General Motors with dividend

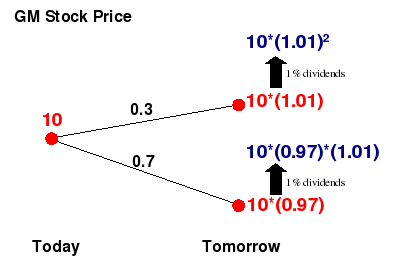

Suppose the

stock price of GM is as in

example

3 of the second lesson. But now assume that we know that the

company will pay dividend at some point between today and tomorrow

(this is a very unrealistic assumption considering the current crisis

that "The Big Three" automakers, General Motors, Chrysler and Ford are

facing). We consider our time horizon to be 1 day and assume that the

dividend payment is 1% of the amount in dollars invested in the stock.

Also, as in example 3, we suppose that the riskless interest rate is

2%. The dividend payment between today and tomorrow has an effect on

the price of the stock by pushing it up by 1% as shown in the figure

below.

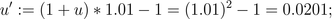

We have then

that

d'< r=0.02 < u', and according

to

activity

2 of lesson 3,

in this

case the market is arbitrage free.Activity

1

Explain why in this case the strategy:

short

one unit of the risky asset and invest $10 in the money market account

in no longer an arbitrage opportunity. What is the

risk

neutral probability q*

in this case.

Example:

Dollar Vs. Euro

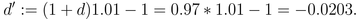

In

example

2 we assumed that investors can borrow or lend Euro with no

interest rate. Clearly, this assumption is not realistic and it is

important to revise this example when the interest rate in Europe is

not supposed to be 0. Suppose now that the interest rate in Europe is

the same as it is in the US, namely 10%. If this is the case, the

arbitrage opportunity described in example 2 is no longer an arbitrage

opportunity: if you

short

one Euro and lend $1.5, tomorrow you will get $1.65 but you will owe

1.1 Euro. If the price of the Euro goes up, once you pay back your

debt, you will end up with a net loss of $(1.65*1.1)-$1.65=$0.165.

Hence the strategy of "going short on the Euro and long on the Dollar"

is not riskless and hence not an arbitrage opportunity anymore. The

natural question that arises then is: Is it possible to adjust this

strategy to get an arbitrage strategy? or, Is under these circumstances

the market arbitrage free?

To answer this

question we reason as in the example above. The fact that the interest

rate in Europe is 10% is equivalent to saying that the price of one

Euro tomorrow is 1.1 times the price today. To account for this fact we

can redefine the price and rates of return of the "risky" Euro after

one period of time (see

the

binomial model and figure above):

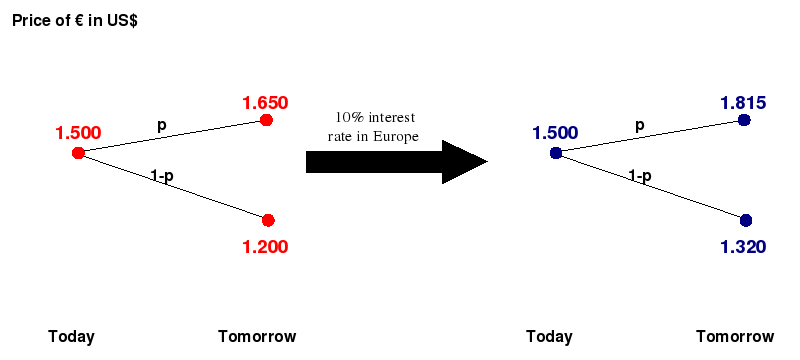

We have then

that

d'< r=0.1 < u', and according to

activity

2 of lesson 3,

in this

case the market is arbitrage free.

Activity

2

In

activity

1 b) of the first lesson, we observed that when the interest

rate in the US is 5% and the interest rate in Europe is 0% then the

binomial model is arbitrage free. Explain why if the interest in Europe

were 31.25% the model would not be arbitrage free and exhibit an

arbitrage opportunity in this case.

The general case

In the examples above we assumed that the risky asset pays dividend as

a percentage of the value of the asset. Suppose that this percentage is

s. As we noticed above we can reduce the

problem to the one consider in

lesson

1 by adjusting the price of the risky asset and the rates of

return, namely

This very simple observation and

the

first fundamental theorem of asset pricing allow us to

conclude that in this case the market is arbitrage-free if and only if

d'<

r< u'.

Activity 3

-

Assuming that the interest rate r is fixed, under

what conditions on the dividend rate s the model is

arbitrage free?

- If the model is arbitrage free,

what is the risk

neutral probability q*

in terms of r and s?

- What is the fair price

you would have to pay today,

for 1 unit of the risky asset with delivery tomorrow? Discuss the

difference between the price when the stock pays no dividend and the

price you found. Hint: Use the probability q*

of part b) to calculate the price.

In the

multi-step case assuming that dividends are paid in every time

step and are all equal to

s% the

the

first fundamental theorem of asset pricing as proven in

lesson 3, states that

d'< r< u' is

also a sufficient and necessary condition for the multi-step model to

be arbitrage free. However, if dividends are not paid on a regular

basis, or are not equal, we can not utilize the binomial model as

presented in module 1 for our arguments. To cover this case, we refer

the reader to

lesson

9 where we study the case when the rates of return of the

risky asset are time dependent.