In the previous lessons we introduced

the Binomial Model. As we saw this model consists of one

riskless asset whose price changes over

time by a fixed

interest rate r and one risky asset

such that its

rate of return at any time can only take two possible values

a or b with

probabilities p and 1-p,

respectively. This rather simple structure prompted an

interesting question about conditions for the existence of

strategies to beat the market or

arbitrage opportunities. Regarding this issue we presented

the

First Fundamental Theorem of Asset Pricing reaching the

conclusion that if p is not 0 or 1 the market is

arbitrage-free if and only if a < r < b

.

In this section we will give a brief introduction

to the

concept of Financial Derivative. Financial Derivatives are

financial instruments used by investors to reduce the risk in the

market. These instruments give a more complex structure to

Financial Markets and elicit one of the main problems in

Mathematical Finance, namely to find fair prices for them. Under

more complicated models this question can be very hard but under

our binomial model is relatively easy to answer.

We say that y

depends linearly on

x1, x2,

..., xm if

y=a1x1+a2x2+

... +

amxm for some

constants

a1, a2,

..., am. Hence,

the payoff of a financial derivative is not of the

form

aS0+bS, with a

and b

constants.

Formally a Financial Derivative is a security

whose payoff

depends in a non-linear way on the primary assets,

S0 and S

in our model (see Tangent).

They are also called derivative securities and are

part of

a broarder cathegory known as contingent claims.

Contingent claims do not necessarily depend on the primary

assets. There exists a large number of derivative securities that

are traded in the market, below we present some of them.

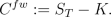

Forward Contract

Under a forward contract, one agent agrees to sell to another

agent the risky asset at a future time for a price

K

which

is specified at time 0. The owner of a Forward Contract on the

risky asset

S with maturity

T

gains the difference

between the actual market price

ST

and the

delivery price K if

ST

is larger

than

K at time

T. If

ST

< k,

the owner loses the amount

K-ST

to the issuer

of the forward contract. Therefore, we can express the payoff of

Forward Contract by

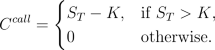

Call Option

The owner of a call option on the risky asset

S has

the

right, but no the obligation, to buy the asset at a future time

for a fixed price

K, called

strike

price.

When the owner has to exercise the option at maturity time the

option is called a

European Call Option. When the

owner

can choose the time to exercise his option it is known as an

American Call Option. The payoff of a

European Call Option

is of the form

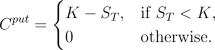

Put Option

Conversely, a put option gives the right, but no the obligation,

to sell the asset at a future time for a fixed price

K,

called

strike price. As before

when the owner has

to exercise the option at maturity time the option is called a

European Put Option. When the owner can

choose the time to

exercise his option it is known as an

American Put Option.

The payoff of a European Put Option is of the form

Remarks

We have seen in the previous examples that there are two

categories of options,

European type options and

American type options. This extends also

to financial

derivatives in general. The difference between the two is that

for European type derivatives the owner of the contract can only

"exercise" at a fixed maturity time whereas for American type

derivative the "exercise time" could occur before maturity.

In this section we will

concentrate our

attention on European type derivatives because they are

easier to price than American type derivatives.

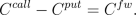

There is a close relation between forwards and European call and

put options which is expressed in the following equation known as

the

put-call parity

Hence, the payoff at maturity from buying a forward contract is

the same than the payoff from buying a European call option and

short selling a European put option.

Pricing

Once financial instruments like forwards and European call and

put options are defined the first question to answer is: what is

the

fair price that the seller of a Financial

Derivative

should charge to the buyer? In the previous lesson we have

developed the machinery necessary to answer this question. A fair

price of a European Type Derivative is the expectation of the

discounted final payoff with repect to a

risk-neutral

probability measure. These are fair prices because with them the

extended market in which the derivatives are traded assets is

arbitrage free (see

the

fundamental theorem of asset pricing).

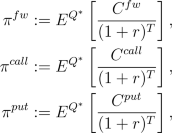

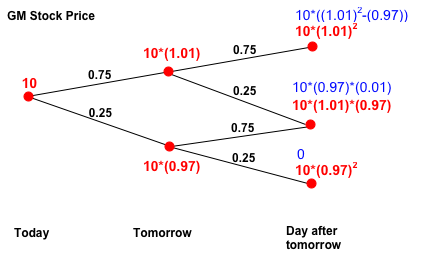

In the arbitrage-free CRR model with p

strictly between

0 and 1 and a < r < b according to Acitvity

2 in the previous lesson we obtain the following prices for

forwards and European call and put options

where,

for any time

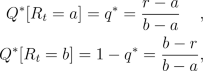

t. For instance, consider the market

given in

Example

3 but with

r=0. In this case

b=0.01

and

a=-0.03. The risk neutral measure is

given then by

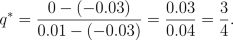

Consider a European call option with maturity of 2 days

(

T=2) and strike price

K=10*(0.97).

The risk

neutral measure and possible payoffs of this call option can be

included in the binary tree of the stock price as follows

We find then that the price of this European call option is

It is easy to see that the price of a forward contract with the

same maturity and same forward price

K is given by

By the put-call parity mentioned above we deduce that the price

of an European put option with same maturity and same strike is

given by

That the call option is more expensive than the put option is due

to the fact that in this market, the prices are more likely to go

up than down under the risk-neutral probability measure. This

does not happen if one considers the initial probabilities

p and

1-p.

Remark

Initially one is tempted to believe that for high values of

p the price of the call option should be

larger since it

is more certain that the price of the stock will go up. However

our arbitrage free argument leads to the same price for any

probability

p strictly between 0 and 1. How can

this be?

The best economical explanation is the following: If the

probability

p is almost one this reflects a change

in the

market participants risk aversion. Hence for large values of

p either the whole price structure

changes or the risk

aversion of the participants change and they value less any potential

gain and are more averse to any loss.

Activities

- A straddle

is a derivative whose payoff increases

proportionally to the change of the price of the risky asset.

Specifically, a straddle pays at time T the

difference between the price ST

and the price S0 if this

difference is positive and minus the difference if it is negative.

Basically with a straddle one is betting on the price move, regardless

of the direction of this move. Write down explicitely the payoff of a

straddle and find the price of a straddle with maturity T=2

for the model described above.

- Suppose that you want to buy

the text-book for your math finance class

in two days. Today the price of the book is $80 dollars. You know that

each day the price of the book goes up by 20% and down by 10% with the

same probability. Assume that you can borrow or lend money with no

interest rate. The bookstore offers you the option to buy the book the

day after tomorrow for $80. What is the fair fee the bookstore should

charge you for this option?

- Consider the same situation

than in b). Now the library offers you what

is called a discount certificate, you will receive

the smallest amount between the price of the book in two days and a

fixed quantity, say $80. What is the fair price of this contract?