Dutch auction

It is important to point out

that eBay uses the term "dutch auction" differently. eBay's

Dutch auction is a multi-unit auction for several

identical goods to be sold simultaneously to potentially multiple

bidders.

This auction is the converse of the English auction. The auctioneer

calls prices in a decreasing way starting from a high price. The

auction ends when one bidder accepts the price. This type of auction,

rather uncommon, is used, for instance, for selling cut flowers in the

Netherlands, fish in Israel and tobacco in Canada.

We will see that the main difference between the equilibrium in the

Dutch and English auctions is that in the Dutch auction the equilibrium

strongly depends on the bidder's guess about the others decision rules,

while in the

English auction

the bidder's strategy does not depend on what he/she believes about

his/her rivals bids. To better understand this difference, it is

important to define the concept of

Bayesian Nash Equilibrium.

Activity 1

Organize a Dutch auction with two of your friends. Assume that their

valuations satisfy the same properties as the ones listed in the

example presented at the beginning of the

previous

lesson. You will act as the auctioneer and they will act as

two bidders. Explain the rules of the game to the bidders in a clear

manner. What is the outcome of the auction? How would the outcome have

changed if some of the hypotheses A1-A4 are relaxed?

Bayesian Nash Equilibrium

For simplicity we will introduce the concept in the context of auctions

satisfying hypotheses A1-A4 of

lesson

1. A generalization to the general case of games with

incomplete information is natural. Suppose that there are

N

bidders in an auction, with valuations

v1,...,vN.

The believes of bidder

i about other bidders'

valuations are independent of

vi

and they are the same for all bidders. Let's denote by

V-i

the set of all possible combinations of valuations of all bidders

except for bidder

i. A

Bayesian

Nash Equilibrium is a set of

strategies,

(s*1,...,s*N),

that specify the actions of the players given their own valuations and

such that for each bidder

i,

the strategy s*i(vi)

is on average the best response, assuming i's

rivals play according to (s*1,...,s*N).

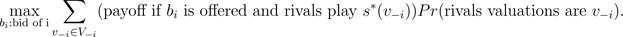

In other words

s*i(vi)

solves the maximization problem (see figure)

This definition might appear to be rather complicated because of the

notation. However, a careful analysis of this concept reveals that it

is a natural generalization of the concept of

Nash

equilibrium in games with complete information to games with

incomplete information. Summarizing,

in

a Bayesian Nash equilibrium of an auction each bidder chooses his/her

best bid given his guess about the decision rules being followed by

his/her rivals (correct guess in equilibrium).

Activity 2

Explain why bidding their own valuation is a Bayesian Nash equilibrium

in a second-price sealed-bid auction (see

previous

lesson).

It is easier to understand the outcome of a Dutch auction by studying

the first-price sealed-bid auction.

The first-price sealed-bid auction

This kind of auction has the same structure than the second-price

sealed-bid auction described in the

previous

lesson, except that in this case the winner of the auction

pays his/her own bid for the item. Unlike the English auction, bidders

never see their rivals' bids and can only submit one bid. This type of

auctions are commonly used for selling mineral rights to U.S

government-owned land, and sometimes used for selling artwork and real

estate property. Also, their analysis can be used to understand

tendering of government procurement contracts.

Activity 3

- Organize a first-price

sealed-bid auction with two of your friends.

Assume that their valuations satisfy the same properties as the ones

listed in the example presented at the beginning of the previous lesson. You will act

as the auctioneer and they will act as two bidders. Explain the rules

of the game to the bidders in a clear manner. What is the outcome of

the auction? How would the outcome have changed if some of the

hypotheses A1-A4 are relaxed?

- In a first-price sealed-bid

auction, why is submitting bidders' own

valuation is not an equilibrium anymore?

Example

Suppose that there are only two bidders in a first-price sealed-bid

auction, labeled

i=1,2. The two bidders'

valuations,

v1, v2

are independent and

uniformly

distributed on [0,1]. We claim than in this case submitting

vi/2

is a

Bayesian Nash equilibrium for each player

i

(see figure below). For instance, for player 1 we have to check that

v1/2

maximizes the quantity

(v1-b1)Pr(b1

> v2/2),

over all possible bids

b1.

This last expression is the expected payoff for player 1 if player 2

has the same bidding rule. From the definition of the

uniform distribution this

quantity is equal to

(v1-b1)2b1,

for

b1≤ 1, and

(v1-b1)

for

b1>1.

Activity 4

Complete the reasoning initiated above. It could help to graph (v1-b1)2b1

as a function of b1 for some

values of v1 in [0,1].

Hence in this case the bidder with the highest valuation wins the

auction and pays a price equal to

v(2)/2

(see the definition of

order

statistic). It turns out that the expected value of this

quantity is 1/3, just like in the second-price sealed-bid auction. This

is a general result that we will present in the

next lesson.

We stated before that it is easier to understand the outcome of a Dutch

auction by studying the first-price sealed-bid auction. This is a

consequence of the following theorem.

Theorem

The Dutch auction yields the same outcome as the first-price sealed-bid

auction.

It is quite easy to see why this is the case: in each auction the

bidder faces the same situation, he/she has to decide how high to bid

without knowing the other bidders' decisions, and if he/she wins,

he/she pays a price equal to his/her own bid. Observe that this

conclusion does not depend on hypotheses A1-A4.