The version of the Revenue

Equivalence Theorem that we present in this lesson was first proved by

Vickrey

in 1961. This result

was generalized 20 years later by

Myerson,

and independently by

Riley

and Samuelson.

In this lesson we will state the first important theorem of auction

theory, commonly known as the

Revenue Equivalence Theorem.

Before doing so, we will generalize some results obtained in the

previous lessons to the case when valuations are

continuous random quantities

with certain properties. In order to do this it is important to recall

the concepts of

distribution and density functions

for a continuous random variable.

Distribution and density function

Given a continuous random variable

X, the

distribution

function of X, denoted by

F, is

defined by the formula

When this function is differentiable, we say that

X

has a

density function which is

defined by the formula

For instance, if

X is

uniformly

distributed on

[a,b] the density function

of

x is

f(x)=1/(b-a) if

a≤x≤b

and

f(x)=0, otherwise (see figure).

Activity 1

The definition of distribution function for discrete random quantities

is exactly the same as above. Find the distribution function of the

valuations considered in the first example of

lesson

2.

Expected revenue in the English and Vickrey's

auctions

We observed in lesson 2 that under assumptions A1-A4 the revenue of the

seller in the English and second-price sealed-bid auctions was equal to

the second highest valuation among bidders. In terms of the

order statistics this revenue

is equal to

v(N-1), where

N

is the number of bidders. Assuming that the valuations have a density

function,

f, with some nice properties, it can be

proved that

In fact, we already have used this fact in

lesson

2 for the specific case of the uniform distribution.

Expected revenue in the Dutch and first-price

sealed-bid auctions

In

lesson 3 we observed

that assuming a Dutch or first-price sealed-bid auction has two bidders

whose valuations are uniformly distributed on [0,1]. Under

hypotheses A1-A4, the

Bayesian Nash equilibrium for each bidder is to bid half of his/her

valuation. This result can be generalized to the case of

N

bidders whose valuations have a common density

f,

with some nice properties. It can be proved in this case that a

Bayesian Nash equilibrium for

player

i is to bid

where

vl is the lowest

valuation each bidder can have (if the bidder bids less than this

quantity he/she has zero surplus).

Activity 2

By using the formula above, find the Bayesian Nash equilibrium of a

dutch or first-price sealed-bid auction if there are

N

bidders whose valuations are

uniformly

distributed on [0,1]. Observe that for

N

big, each bidder's bid approaches his/her own valuation.

Hint

Use the fact that the integral between

a and

b

of

xM is

(1/(M+1))(bM+1-aM+1).

Hence in terms of the

order

statistics the expected revenue of the seller in this case is

equal to

It can be shown that this quantity is equal to the revenue of the

seller in the English and Vickrey's auctions (formula above), which

leads to the following theorem.

The Revenue Equivalence Theorem

For the benchmark model, with hypotheses

A1-A4,

each of the English auction, the Dutch auction, the first-price

sealed-bid auction, and the second-price sealed-bid auction yields the

same price on average.

Activity 3

In the activities from the previous lessons, where the outcomes from

the different types of auctions that you organized with your friends,

almost equal on average? If not, could you explain why you think this

happened?

There exists however a fundamental difference bewteen the equilibrium

in the English and Vickrey's auctions and the equilibrium in the Dutch

and first-price sealed-bid auctions. In the latter, the equilibria are

dominant

equilibria in the sense that each bidder has a well

defined bidding strategy regardless of how high his rivals bid. In the

former, the equilibrium for each bidder is optimal given that his/her

rivals are using the same decision rule (

Bayesian

Nash equilibria). Also, recall that in the English auction

the seller never discovers the winner's valuation, but in the

second-price sealed-bid auction the winning bid is actually equal to

the highest valuation. Hence, although the average revenue in all the

auctions is the same, there exist properties that are different for the

different types of auctions. Also, if some of the assumptions

A1-A4 are dropped the

outcome of the auctions could change substantially. For instance, when

assumption A2 is dropped we have the following result.

The winner's curse

Suppose A1, A3, A4 hold but instead of having hypothesis A2

(independent-private-values assumption), there is a common value of the

item that is unknown for all bidders. In this case, for a sealed-bid

auction each bidder makes an estimate about the true value of the item.

The bidder with the highest estimate will win the auction (why?). But

this means that the winner of the auction overestimated the value of

the item, since everybody considered it to be less, and hence he/she

might end up overpaying. A more formal statement of this result uses

conditional probabilities and it is out of the scope of these lessons.

Hence by dropping A2, the winner of the auction might lose the rent

he/she would win if A2 were satisfied.

Activity 4

Have you noticed this phenomenon in the auctions organized in the

previous lessons?

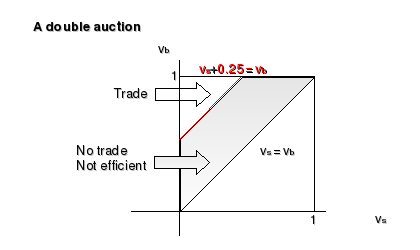

A double auction

Double auctions are used for example in the stock market as described

in

lesson 1. Here we

present a very simple version of a double auction where there is one

seller and one buyer who have private information about the value of

item. The seller names an asking price

ps

and the buyer an offer price,

pb,

simultaneously. A transaction occurs if and only if

pb>ps,

and in this case the price paid for the item is equal to

p=(ps+pb)/2.

Assuming that the valuations of seller and buyer, are uniformly

distributed on [0,1], a Bayesian equilibrium for this auction is given

by the formulas

As a consequence, in this equilibrium trade occurs if and only if

vb≥vs+(1/4)

(see figure). It can be shown that there is no Bayesian Nash

equilibrium that is efficient in the sense that trade occurs if and

only if

vb≥vs.

This auction is different than the ones presented in the previous

lessons in that the seller also takes part in the auction by submitting

an asking price.

Further reading

The results presented in these lessons are merely introductory. Further

results are obtained by relaxing hypotheses

A1-A4. Also auctions are a

particular example of games with incomplete information, additional

results are obtained for sequential games of incomplete information

when for instance, bargaining is possible. In this regard, we refer the

interested reader to the literature below.

References

- Gibbons, R. Game theory for applied economists,

Princeton University Press, 1992.

- McAfee, P. and McMillan, J. Auctions and

bidding, Journal of Economic Literature 25:699-738, 1987.