Price discovery

Market models in financial mathematics often assume that buyers and sellers in the market

act as "price takers". This assumption is reasonable, for example, when

the number of buyers and sellers is big enough so that nobody believes

his actions will influence prices. This hypothesis is known as the

Competitive

market hypothesis. There exist however many

examples when this assumption does not hold and it becomes crucial to

explain where prices come from and the influence of players' actions on

them.

Auction theory provides one

explicit model of price making (ignoring bargaining

aspects of the process).

For instance, the New York Stock Exchange (NYSE) trades everyday in a

continuous time auction format. Specifically, buyers and sellers of a

determined stock submit an offer price and asking price, respectively

(see

double auction).

Whenever the ask price matches the offer price a transaction occurs and

the price of the transaction is the

market price

(quote). Most of the times the bid price is below the offer price. In

this case the difference between the asking price and offer price is

known as the

bid-ask spread.

This quantity measures the level of

liquidity of

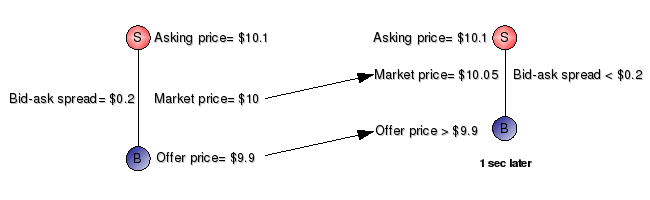

the stock. For example, suppose that the market price of a share of

stock of ABC is $10 (the last price at which a transaction took place).

The maximum bid price is $9.9 and the minimum asking price is $10.1. In

this case the bid-ask spread is $0.2. Suppose that one second later the

market price increases to $10.05 (a transaction occurred at this

price). In this case the buyer with bid price $9.9 may be forced to

reconsider and offer a higher price, which tightens the bid-ask spread

(see figure). The transaction at $10.05 indicates that the stock is

more liquid and hence the bid-ask spread should be smaller.

Regarding the Competitive market hypothesis, it is important to observe

that most of the theory of

Mathematical

Finance has been developed by assuming this hypothesis to

hold. When this assumption is dropped the models become more complex.

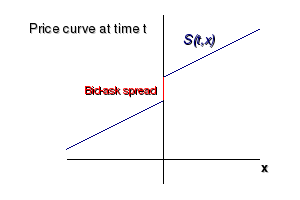

One way to approach non-competitive markets is by specifying in the

model, the price of the assets as a function not only of time but also

of the size of order. In other words for every asset in the market we

would have a family of price processes,

S(t,x) that

model, from the perspective of a large investor, the price of the asset

at time

t if

x shares of the

asset are bought (

x>0) or sold (

x

< 0). There are many assumptions that have to be made

in order to get nice results. The most important one of them is the

fact that as

x increases the price

S(t,x)

should either remain unchanged or increase as well (see figure).

This

accounts

for the fact that if a large number of shares have to be bought, since there is a limited ammount of cheap shares, the investor will have to

pay more on average. It excludes however, a phenomenon often seen in consumer products

when buyers get discounts for purchasing large quantities of a product.

Auction market

A more practical reason for studying auctions is that the

value and diversity of goods exchanged in

the auction market is huge. For instance in 2007 the total

revenue from goods and services sold at live auction was $270.7

billion. Among the many goods exchanged in auctions, excluding online

auctions, are: antiques, collectibles, wines, real estate property,

commodities, US Treasury bills, etc. Online auction companies have

grown in number during the past years. Among them we find eBay,

Amazon.com, Yahoo, etc. Therefore, the size of the auction market

highlights the importance of studying Auction Theory.

The Revelation Principle

From the game-theoretical point of view auctions are

games

with incomplete information or Bayesian games: the

player's payoff functions are not common knowledge. This characteristic

is due to the fact that in an auction, bidders are uncertain about

other players' valuation of the item or good, and sometimes are even

uncertain about their own valuation. A quite useful result in game

theory, states that any

Bayesian

Nash equilibrium in a Bayesian game (no matter the nature of

the game) can be represented as a Bayesian Nash equilibrium of a

particular type of auction in which:

-

The bidders simultaneously make (possibly dishonest) claims about

their valuations. Say, that there are N bidders

with valuations and claims v1,...,vN

and c1,...,cN,

respectively.

-

Given the bidders' claims about their valuations each player i

pays xi(c1,...,cN)

and receives the good with probability qi(c1,...,cN).

The sum q1(c1,...,cN)+...+qN(c1,...,cN)

must be less than or equal to 1.

-

Telling the truth is a Bayesian Nash equilibrium for each player.

An auction with the properties 1.-3. is known as an

incentive-compatible

direct mechanism. This result is known as

The

Revelation Principle, an important tool for

designing games with private information and studying auction and

bilateral trading problems. This theorem simplifies the study of

auctions itself, but at the same time explains why understanding such

mechanisms may be of great importance in order

to

understand the behavior of other institutions.

Subsequent hypotheses

Before going ahead and studying particular examples of auctions, it is

important to state a precise definition of the concept and list the

assumptions we will make in the subsequent lessons. By relaxing or

completely changing some of these assumptions new results are obtained.

The study of more general models is out of the scope of these lessons,

however in

lesson 4 we

mention some results related to extensions of the model.

An

Auction, according to

McAfee and McMillan, 1987, is

"a

market institution with an explicit set of rules determining resource

allocation and prices on the basis of bids from the market participants".

In the auctions that we study in the following lessons there is a

unique

seller of the item or good, known as a

monopolist.

The organizer of the auction

commits himself in

advance to a set of policies, specifying how the

winner of the auction will be selected and the price the winner has to

pay for the item. Additionally we assume that:

- A1. The bidders are risk-neutral.

For instance, obtaining a payoff equal to zero after taking part in the

auction is the same than obtaining a payoff of zero with out submitting

any bid.

- A2. Every bidder knows

precisely how much he/she values the item. Additionally, the valuations

among bidders are independent and the distributions of this valuations

are common knowledge. This is known as the independent-private-values

assumption. We will explain it in more detail in

the next lesson.

- A3. The bidders are symmetric

in the sense that the beliefs of the bidders and seller about the

others valuations are common.

- A4. Payment is a function of

the bids alone.

This model, represents the

benchmark model and

particular examples will be studied in the subsequent lesson.

Activity

Can you think of particular examples of auctions when some of the

hypotheses listed above are violated? How would you think the outcome

of the auction would change in these cases compared to the one observed

when A1-A4 hold?