Hedging is refered to as the

practice of finding hedges and falls into the

framework of risk management. A hedge is an

investment used to reduce or cancel out the risk taken in another

investment.

In the previous lesson we mentioned that Financial Derivatives are

instruments used by investors to reduce the risk in the market. In this

lesson we make this statement more clear through some examples. Before

reading the material of this section it is recommended to review the

notation and concepts of the

arbitrage

opportunities lesson.

Example 4

Suppose that an investor is facing the market described in the last

part of the

previous

lesson. In this market, under the risk-neutral probability

measure, the price of the stock is more likely to go up than down. Call

options on the stock reduce the risk of an investor who wants to buy in

two days, since it is very likely that the price in two days is going

to be higher. As we saw for a strike price of 10*0.97 the price of the

call option with maturity of two days is 0.3181875

Now you can imagine that the seller of the call option would be

interested in having a strategy to cover the call option. One simple

possibility comes from the put-call parity and corresponds to buying a

forward contract with the same forward price and a European put option

with the same strike and maturity. Another less simple alternative

corresponds to finding a strategy in the money market account and risky

asset. In this case the seller wants to find a self-financing strategy

(x,y)

such that the value of the final portfolio is equal to the payoff of

the call option. In order to find such a strategy he will have to solve

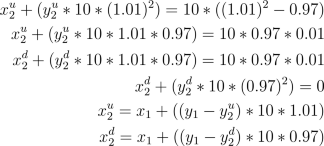

the following system of linear equations

The last two equations account for the self-financing condition (see

last note in

arbitrage

opportunities). The unique solution to this system is

approximately

x1=-7.8631, y1=0.8181,

x2d=-2.3523, y2d=0.25,

x2u=-9.7, y2u=1.

Since in this case the system of equations has an exact solution we

call the trading strategy

(x,y) a

perfect

hedge or

replicating strategy

for a European call option with maturity of two days and strike

10*0.97. Observe that the initial portfolio corresponds to borrowing

approximately 7.8631 in money and buying 0.8181 shares of the stock.

The value of this initial portfolio is approximately 0.32, the price of

the European call option. This is not a coincidence and can be

generalized for any perfect hedge.

Proposition

If the self-financing portfolio

(x,y) is a perfect

hedge of a contingent claim with final payoff

C,

the value of the initial portfolio

(x1,y1)

is equal to the arbitrage free price of the claim,

EQ*[C/(1+r)T].

Here,

Q* is any risk-neutral

probability measure.

Note

The procedure described in Example 4 above shows how to hedge or

replicate a European call option with maturity of 2 days and strike

equal to 10*0.97 by using the money market account and the risky asset.

This method can be generalized to any contingent claim and in

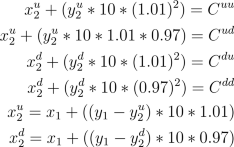

particular to any Financial Derivative. Let

Cuu,

Cdu, Cud and Cdd

be the payoffs when the price goes up both of the days, goes up the

first day and down the second day, goes down the first day and up the

second day and goes down both days, respectively. Then finding a

perfect hedge,

(x,y) for this claim corresponds to

solving the following system of six linear equations with six unknowns,

x1, y1,

x2d, y2d,

x2u, y2u,

It is a known result of linear algebra that if a system like this has a

unique solution

for some values of

Cuu,

Cdu, Cud and Cdd

then it has a solution

for any Cuu,

Cdu, Cud and Cdd.

Hence, since we could find a perfect hedge for a European call option

we can find a pefect hedge for any contingent claim. When the latter

holds we say that the market consisting of the money market account and

the risky asset is a

Complete Market. In our model

the market completeness is an immediate consequence of the fact that

the risk-netral measure

Q*

is unique and the following theorem.

The Second Fundamental Theorem of Asset Pricing

A market is complete, i.e any contingent claim can be perfectly hedged,

if and only if, there exists a unique risk-neutral probability measure

in the market.

Further Analysis

Up to this point we have seen the conditions under which the CRR model

with only one risky asset is arbitrage-free. We saw that if these

conditions are satisfied then the market is complete and the

arbitrage-free price of any contingent claim is the value of the

initial portfolio of any replicating strategy or perfect hedge. All

this questions become more interesting when we modify our assumptions

and we allow more than one risky asset in the market, more than two

rates of return at any time and we put constraints to the

self-financing strategies, e.g. if short-selling is not allowed or is

bounded below by a fix quantity. This elucidates the level of

complexity reached by Financial Markets from the mathematical point of

view.

Activities

- Consider the CRR model of Example

2 with rate of interest r=0.05. Explain

why this model is arbitrage-free. Find a perfect hedge for a European

put option with maturity of one day and strike price equal to 1.5.

- Consider the CRR model of Example

3 with rate of interest r=0. Find a

perfect hedge for a straddle with maturity of one day (see activity a)

of the previous

lesson).

- You want to sell a bottle of

wine to a friend of yours who has a

romantic dinner with a date tomorrow. The price of the bottle today is

$30. You know that this price either goes up by %10 percent or down by

%50 with the same probability. You can borrow or lend money with no

interest rate. You agreed with your friend that tomorrow he will pay

the minimum between the price tomorrow and the current price. How much

should you charge your friend for this? How would you hedge your

position?