Cox, Ross and Rubinstein developed the Binomial

Model in

1979,

which is also known as the CRR model.

We will first present it through some examples before explaining the

general case.

Example 1: One step model

Suppose that today €1=$1.5. Assume that you know

that

tomorrow the Euro

will be worth either $1.2 with probability

1-p or $1.65 with probability p.

Assume also that you can borrow or lend money in dollar currency

at a fixed interest rate of 10%. Under these circumstances the

market that you are facing can be modeled by a one step binomial

model. One step because you are only given information about the

Euro value tomorrow, binomial because there are only two possible

values of the Euro tomorrow. The assumption that you can borrow or lend

money at a fixed interest rate is a common assumption in

short term financial models.

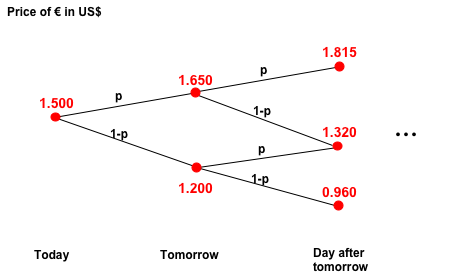

Example 2: Multistep Model

A natural generalization to the situation

presented in

the

previous example arises when you face such a problem on a daily

basis for a determined period of time. For example, suppose that

today €1=$1.5 and for any given day of the month the

probability of the price of the Euro to go down by 20% is

1-p while the probability of the price

going

up by 10% is

p. As before assume that you can borrow

or

lend money at a

fixed daily interest rate of 10%. In this case the market can be

modeled by a multistep binomial model and the best way of

visualizing such a model is through a binary tree like the one

shown below.

The general case

The CRR model with time horizon T

involves a

riskless bond (which can be interpreted

as a money

market account or T-bonds)

and a risky asset (e.g. stocks, bonds, commodities such as oil or gold,

currency exchange rate, pork bellies etc.). The price process of the

riskless bond is

with r > -1. The price

process of the risky

asset is denoted by

St for t=0,1,...,T

where

with Rt

the

return in the the tth trading period.. The return Rt

can only take two possible values -1 < a < b.

This implies that the price of the risky asset at any time t,

either jumps to

the higher value St (1+b) or

to the lower value

St (1+a).

Example 2 (continued)

The action of borrowing

risky

assets and

selling them immediately is called Selling short.

Investors who believe the price of an asset is going to drop will short

sell this asset.

We have in this case that the riskless bond is the

dollar, the

risky asset is the Euro, T is the number of days

remaining

in the month, r=0.1, a=-0.2 and

b=0.1.

Suppose further that you can borrow Euros with no interest, that

p=0.5 and that there is only one day

left in

the month (so that

you are facing a one step situation). You could take advantage of

this circumstance by using the following strategy: borrow one

Euro today, sell it immediately for $1.5 and lend this money

(see Tangent). Tomorrow you will get for sure $1.65, since

the interest rate is 10%. If the price of the Euro goes up to

$1.65 you use your money to buy an Euro and pay your debt

obtaining a net gain of $0. If the price of the Euro goes down to

$1.2, you buy an Euro to pay your debt but in this case your

ending balance is $1.65-$1.2=$0.45. Hence by following this

strategy you can make $0.45 with a probability of 0.5 and no risk. Of

course you could do the same with an arbitrary amount of Euros in

the beginning, which generates even greater gains.

Activity 1:

- Assume

you are facing the

situation presented in the last example but there are two days

left in the month instead of just one. Find a strategy such that

the net gains are always nonnegative and positive with positive

probability.

- Can you find such a

strategy if the interest rate r is 5% instead of

10%?

Activity 2:

- The price of one gallon

of gasoline on January 1st is $4. On January

2nd this price can either go up to $4.40 or go

down to

$3.60 with the same probability. If the interest rate r

is

20%, can you find a strategy such that on January 2nd

the net gains are always nonnegative and positive with positive

probability?

- Suppose that the same

pattern holds until January 4th. Draw a binary

tree

modelling the market. Can you find a strategy such that on

January 4th the net gains are always nonnegative

and

positive with positive probability?

- What happens if the

interested rate r is equal to 0?

Note:

Assume

that you can short

sell gasoline.

The situations presented in the previous examples

give

rise to the

following question: under which circumstances is it possible to

find a strategy to beat the market, in the sense that by

following such strategy at time T you will have a positive profit

with positive probability and no risk? We discuss this issue in the

next lessons.