In the previous lesson we presented in Example

2 a binomial market where it is possible to find an

investment strategy that yields a positive profit with positive

probability but without any downside risk. Such a strategy is

commonly known as an arbitrage opportunity.

Before giving a formal definition of an arbitrage

opportunity

it is important to introduce some notation to clarify the

concepts of trading strategy and

most importantly

self-financing trading strategy.

A trading strategy

is a process that for any time t specifies the

quantity of

shares in the money market account S0

(in our

examples this corresponds to the amount of money in dollar

currency) and the number of shares of the risky asset S

held by the investor between times t-1 and t.

We

use the following notation for a trading strategy:

It is important to notice that xt

and

yt could take

negative values which corresponds

to borrowing money and short selling the risky

asset,

respectively. For instance the strategy presented in Example

2 could be written as x1=1.5

and

y1=-1.

With this notation ytSt-1

is the amount invested into

the risky asset at time t-1, while ytSt

is the resulting value at time t. We define the value

of the portfolio (c,d) at time t,

by

The term arbitrage is

commonly referred to as the practice of taking advantage of the price

differential between two markets by buying and selling assets.

This section is mainly dedicated to making this statement precise. A

market with asset prices that rule out these practices is called an arbitrage-free

market. An investor that is engaged in an arbitrage opportunity is

called an arbitrageur.

We will have a

self-financing trading strategy

if for any

t greater than or equal to 1 and less

than or equal to

T-1, the value of the portfolios

(xt,

yt) and

(xt+1,

yt+1) at time

t

are the same. By the observation made in the beginning of the

paragraph, this is equivalent to say that the fluctuations in the value

of the portfolio are equal to the gains and losses resulting from asset

pricing fluctuations only, i.e. there are no cash flows coming in or

out.

We define formally an arbitrage

opportunity (see Tangent) as a self-financing

trading strategy (x,y) such that the value of the

initial portfolio (x1,y1)

at time 0 is less than or equal to 0, but the value

of the final portfolio (xT,yT)

at time T is nonnegative with probability 1 and

positive with positive probability.

In order to clarify the concepts and notation introduced above we

present some examples.

Example 2 (continued)

The strategy presented in the

previous

lesson corresponds to

x1=1.5

and

y1=-1. Since we

are facing a 1 period model the self-financing condition trivially

holds. Observe that the value of the portfolio

(x1,y1)

at time 0 is

However, the

value of the

same portfolio at time 1 is either 1.5*1.1+(-1)*1.65=0 with probability

0.5 (i.e. if the Euro goes up) or

1.5*1.1+(-1)*1.2=0.45 with the same probability (i.e. if the Euro goes

down). This is an example of an arbitrage opportunity in a one

step binomial market. We say in this case that the market is not

arbitrage-free.

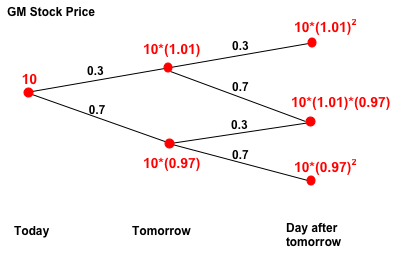

Example 3

Suppose that today the price per share of Stock for General Motors

Corp. (GM) is 10. For the next two days the rate of return is either 1%

with

probability 0.3 or -3% with probability 0.7. Suppose further that the

rate of interest in the money market is 2%. We claim that this binomial

market is not arbitrage-free. Consider the following trading strategy,

(x,y)

x1=x2u=x2d=10,

y1=y2u=y2d=-1,

where

(x2u,y2u)

and

(x2d,x2d)

are the portfolios when the price of the stock after the first day goes

up and down, respectively. Since the portfolio does not change at any

time this trading strategy is trivially self-financing. At time 0 the

value of the portfolio

(x1, y1)

is 10*1+(-1)*10=0. If the price of the stock goes up on day 1 and day 2

then the value of the final portfolio

(x2u,y2u)

is equal to 10*(1.02)

2+(-1)*10*(1.01)

2=0.203.

This event occurs with probability 0.3*0.3=0.09 (see

Probability

Review). If the price of the stock goes down one day but up

the other day the value of the final portfolio

(x2u,y2u)

or

(x2d,y2d)

is equal to 10*(1.02)

2+(-1)*10*(1.01)*(0.97)=0.607.

Each of these events occurs with probability 0.3*0.7=0.21. Finally, if

the price of the stock goes down on day 1 and day 2 the value of the

final portfolio

(x2d,y2d)

is equal to 10*(1.02)

2+(-1)*10*(0.97)

2=0.995

This event occurs with probability 0.7*0.7=0.49. Hence, regardless what

occurs during these two days the value of the final portfolio is

positive and this trading strategy is an arbitrage opportunity. This is

an example of a 2 step binomial market that is not arbitrage-free.

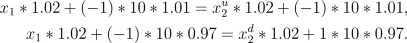

Note on self-financing strategies

So far in our examples the self-financing condition holds trivially. In

order to better understand the concept, consider the market described

in the previous Example and suppose that at time 0 the investor short

sells one share of stock (i.e. borrows one share of stock from the

broker). At time 1, if the price goes down he pays the stock back to

the broker and buys one share in the market, and if the price goes up

he does nothing. With our notation the strategy on the stock can be

written as

x1=10, y1=-1,

y2u=-1, y2d=1.

Intuitively in order to have a self-financing strategy, the strategy on

the money account should balance off the fact that between times 1 and

2 the investor paid back stock to the broker and bought new stock in

the market. Formally with the notation developed we have to find

x2u

and

x2d

such that the following holds

We notice that

x2u=x1=10

and

x2d=x1+(-2)*(10)*(0.97)/(1.02)

is the unique solution to the system above.

The reasoning above can be generalized and

summarized by the following observation. Given any initial portfolio (x1,

y1) and

any strategy on the risky asset S, y2,

..., yT, there exists a unique

strategy on the money market, x2, ...,

xT, such that the trading strategy (x,y)

is self-financing. This strategy can be found by successive use of the

following formula

Activities

- Consider the

market described

in Example 3 but assume that the interest

rate r=0. Given an arbitrary initial portfolio (x1,

y1) and an arbitrary strategy on the

risky asset S, y2,

find a strategy on the money market, x2,

such that the trading strategy (x,y) is

self-financing.

Hint:

Recall that you have to consider two market states, one when the price

of the stock goes up the first day and the other one when the price

goes down. Hence, your strategy on the money market corresponds to two

variables x2d

and x2u

which should be given in terms of x1, y1,

y2d, y2u.

- For the

strategy found in part

a), write down explicitly

the value of the initial portfolio and the possible values of the final

portfolios in terms of x1, y1,

y2d, y2u.

- Explain

why

it is impossible to

find x1,

y1, y2d,

y2u such that

the value of the initial portfolio is nonpositive but the value of the

final portfolio is always nonegative and positive at least once. In

other words, explain why this market is arbitrage-free.

Hint:

In order to prove this you will have to consider a system of

inequalities and explain why it is not consitent, i.e. why there are no

values of x1, y1,

y2d, y2u

that satisfy all the inequalities at the same time. At least one of the

inequalities should be strict; this corresponds to the fact that in an

arbitrage the value of the final portfolio is positive for at least one

market state.