|

Families of Risky Assets

The New York Stock Exchange

(NYSE), the largest and most liquid cash equities exchange in the

world, lists over 3,000 world's leading large- and medium-sized

companies. A full listing directory of these companies can be found here.

Markets are

usually diverse and a large amount of assets can be traded (see

tangent). In the present lesson we will extend the theory previously

developed to markets with more than one risky asset. Implicitly this

extension was already considered when explaining the pricing

theory of contingent claims in the binomial model. The fair

price of a contingent claim was defined so that the extended

market, in which the claim is traded, is arbitrage free. In

this section we will make this statement more precise and also clarify

how prices of European type contingent claims at intermediate times are

defined.

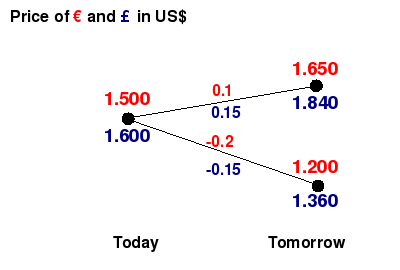

Example:

Dollar Vs Euro, Dollar Vs British Pound

Assume that

the interest rate in the US is 5%. Suppose for now, that you can borrow

and lend Euro and British Pounds with no interest rate. In the diagram

below we give the risky exchange rates of the

Dollar against the Euro (red) and British Pound (blue) for today and

tomorrow. The branches of the tree can occur with equal probability of

0.5 and correspond to the two states of the world, when the exchange

rates go up and down, respectively.. Along each of the branches we have

placed the corresponding rates of return.

The theory

developed in the first module guarantees that in this market there does

not exist an arbitrage opportunity that trades only Dollars and Euro or

only Dollars and British Pounds, because the interest rate, r,

is strictly between the high and low rates of return in each case.

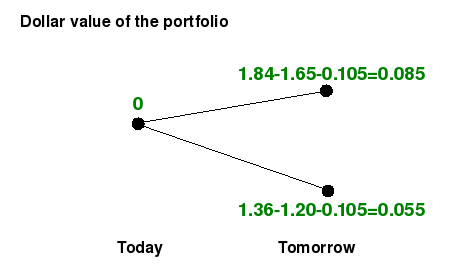

However, one might ask, is there an

arbitrage opportunity that trades on the three currencies

simultaneously? The answer to this question is

affirmative. An example of such an opportunity is the following: short-sell

€1, borrow $0.1 and buy ₤1. The dollar value today of this strategy is

$-1.5-0.1+1.6=$0. The possible values of the portfolio tomorrow are

given in the digram below. Each branch in the tree occurs with the same

probability of 0.5.

We observe

that this strategy represents an arbitrage opportunity: regardless the

state of the world, this strategy guarantees positive profits.

Activity

1

Assume that the British Pound's interest rate is 0%, but the Euro's

interest rate is 5% (see previous

lesson). Explain why the strategy presented above is no

longer an arbitrage opportunity in this case.

This example

shows that testing for the existence of arbitrage opportunities in a

general multi-asset model by just using the definition can become a

very complicated problem. Luckily for this end, we can extend the

previous theory and use the Fundamental Theorem of Asset Pricing in multi-asset

markets as stated below.

The FFTAP in

multi-asset models

The model presented here is

a one factor model in the following sense. At each

time, there are only two possible movements in the market prices,

either all of them jump up or all of them jump down simultaneously. The

reason why it is called a one factor model is that the probability of

each event occurring can be determined by just flipping one and only

one coin. Multi-factors models will be briefly described in lesson

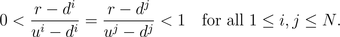

11. We generalize

the model presented in module 1 as follows. Suppose that the market

consists of a riskless asset with price process St0=(1+r)t

and N risky assets

with price processes S1,...,SN.

Assume further that after each time t the price

processes jump from St1,...,StN

to either St+11=(1+u1)St1,...,St+1N=(1+uN)StN

or St+11=(1+d1)St1,...,St+1N=(1+dN)StN,

each of these events occurs with positive probability and dj

< uj for all j

between 1 and N (see tangent). This multi-asset

model is arbitrage free if an only if

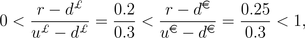

In our example

above, we have that r=0.05, d€=-0.2,

u€=0.1, d₤=-0.15

and u₤=0.15. Then

and the model

is not arbitrage free (we exhibited an example of an arbitrage

opportunity above). It is important to point out that this theorem

states that the model is arbitrage free if and only if there exists a probability under which all

the discounted risky assets are simultaneously

martingales (see lesson

3).

Activity

2

-

Explain why the model of activity 1 above is arbitrage free. Fixing r=0.05,

find conditions on the interests rates for the Euro and British Pound

for which the model is arbitrage free (see previous

lesson).

- Suppose that General Motors

(GM) stock's price behaves as in example

3 of lesson 2. Assume that Ford Motor Company (F) stock's

price has rates of return of either 2% when GM stock's price goes up or

-2% when GM stock's price goes down. If the dollar's interest rate is

0%, is the market in which GM and F stock are traded arbitrage free?

Price of

European type claims

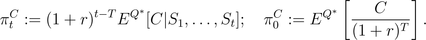

As mentioned

in the beginning of the lesson the fundamental theorem of asset pricing

for multi-asset markets clarifies the pricing theory of contingent

claims in the binomial model. According to the theorem, if the

contingent claim with terminal payoff C is traded

at intermediate times between present time and maturity time, the

prices of the claim at intermediate times have to be such that the discounted

price process is a martingale

with respect to the probability q*.

Since at maturity time the price of the claim is equal to its payoff C,

we conclude that at time t the price of the claim

is

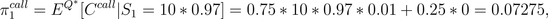

For instance,

consider the example given in lesson

4. In this case the possible prices of the call option on the

GM stock with maturity date T=2 and strike price

10*0.97 at time t=1 are either

if the price

of the stock increases the first day, or

if the price

of the stock decreases the first day. We observe that the price of the

option is higher when the stock price increases than when it decreases,

which makes perfect sense by the definition of a call

option.

Activity

3

- Verify that in the example

above the rates of return of the stock and

the call option satisfy the condition given in the fundamental theorem

of asset pricing for multi-asset models.

- Find the prices at all times of

a put

option on the GM stock, with maturity T=2

and strike price of K=10*0.97.

|