A first version of this

theorem was proven by M. Harrison and D. Kreps in 1979. More general

versions of the theorem

were proven in 1981 by M. Harrison and S. Pliska and in 1994 by F.

Delbaen and W. Schachermayer. For these

extensions the condition of no arbitrage turns out to be too narrow and

has to

be replaced by a stronger assumption.

As we have seen in the previous lesson, proving that a market is

arbitrage-free may be very tedious, even under very simple

circumstances.

In this lesson we will present the first fundamental theorem of asset

pricing, a result that provides an alternative way to test the

existence of

arbitrage opportunities in a given market. When applied to binomial

markets, this theorem gives a very precise condition that is extremely

easy to verify (see Tangent).

Before stating the theorem it is important to

introduce the concept of a Martingale.

In simple words a martingale is a process

that models a fair game. To make this statement

precise we first review the concepts of conditional probability and

conditional expectation.

Note

We define in this section the concepts of conditional probability,

conditional expectation and martingale for random quantities or

processes that can only take a finite

number of values. This turns out to be enough for our purposes because

in our examples at any given time

t we have only a

finite number of possible prices for the risky asset (how many?). In

more general circumstances the definition of these concepts would

require some knowledge of measure-theoretic probability theory.

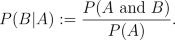

- Conditional Probability

- Given two events A and B

such that P(A) (the probability of A)

is not 0, the conditional probability

of B given A is defined by

-

- This

probability

is interpreted as the probability of B given that A

has occured. If the events A and B

are independent we have that P(B|A)=P(B). For

instance, in Example

3 of the previous lesson we have that the probability that

the price of the stock goes up the second day given that it went down

the first day is equal to P(price goes up the second day)=0.3.

- Conditional Expectation

- Once we have defined conditional probability

the definition of conditional expectation comes naturally from the

definition of expectation (see Probability

review). Given a random variable or quantity X

that can only assume the values x1, x2,

..., xn with possitive probability and

an event A such that P(A) is

not 0, the conditional expectation of X given A

under the probability P is

- For instance in Example

3 of the previous lesson we have that

- EP (S2|S1

= 10*0.97)

= 10*0.97*1.01P(S2 = 10*0.97*1.01|S1

= 10*0.97) + 10*(0.97)2P(S2

= 10*(0.97)2|S1 =

10*0.97)

=

10*0.97*1.01*0.3 + 10*(0.97)2*0.7

= 9.5254.

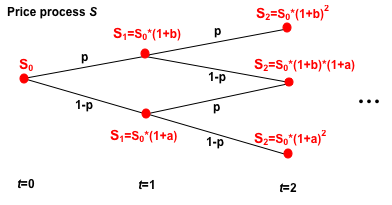

- Martingale

- A random process X0,

X1, ..., XT,

such that for every t between 0 and T,

Xt can only

assume finitely many values xt1,

..., xtnt,

is said to be a Martingale with respect to the

probability measure P if

-

- for all s and i0,

..., is. In other words the

expectation under P of the final outcome XT

given the outcomes up to time s is exactly the

value at time s.

This happens if and only if for any t

Activity 1:

- Suppose Xt

is a gambler's fortune after t

tosses of a "fair" coin (i.e P(heads)=P(tails)=0.5),

where the gambler wins $1 if the coin comes up heads and loses $1 if

the coin comes up tails. By using the definitions above prove that X

is a martingale. This is also known as D'Alembert system and it is the

simplest example of a martingale. It justifies the assertion made in

the beginning of the section where we claimed that a martingale models

a fair game.

- Consider the market

described in Example

3 of the previous lesson. Is the price process of the stock a

martingale under the given probability?

The Fundamental Theorem

A financial market with time horizon

T and price

processes of the risky asset and riskless bond given by

S1,

..., ST and

S10,

..., ST0,

respectively, is arbitrage-free under the probability

P

if and only if there exists another probability measure

Q

such that

- For any

event A, P(A)=0 if and only if Q(A)=0.

We say in this case that P and Q are equivalent

probability measures.

- The discounted

price process,

X0:=S0/S00,

..., XT:=ST/S0T

is a martingale under Q.

A measure

Q that satisifies (i) and (ii) is known

as a

risk neutral measure. After

stating the theorem there are a few remarks that should be made in

order to clarify its content. The first of the conditions, namely that

the two probability measures have to be equivalent, is explained by the

fact that the concept of arbitrage as defined in the previous lesson

depends only on events that have or do not have measure 0. More

specifically, an arbitrage opportunity is a self-finacing trading

strategy such that the

probability that the value of the

final portfolio is negative is zero and the

probability

that it is positive is not 0, and we are not really concerned

about the exact probability of this last event.

Also notice that in the second condition we are not requiring the price

process of the risky asset to be a martingale (i.e a fair game) but the

discounted price process. This can be

explained by the following reasoning: suppose that the price of the

risky asset is measured in dollars. If at time

t

the price of the risky asset is $x, the fair price the seller should

charge at time 0 for the asset should be $x/(1+r)

t,

with r the interest rate. If he charges $y<$x/(1+r)

t

then the buyer could take advantage of the situation by borrowing $y at

time 0 to buy the asset and then selling at time

t

to repay his debt of $y(1+r)

t, obtaining a

positive profit of $(x-y(1+r)

t). If he charges

$y>$x/(1+r)

t then he could take advange

of the situation by selling the asset at time 0 and lending $y dollars

so that at time

t he would receive $y(1+r)

t

and after buying back the asset he would make a positive profit of

$(y(1+r)

t-x). Basically when one considers the

discounted price process every price is being measured in the unity of

the riskless asset

S0, which

is also commonly known in the literature as the

Numéraire.

Activity 2:

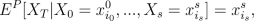

Application of the FFTAP to the CRR Model

Consider a

CRR

Model with interest rate

r. Assume that

at any time

t the return rate of the risky asset

R

satisifes

P(Rt=b)=p and

P(Rt=a)=1-p

with p

strictly greater than 0 and

strictly

less than 1. A binary tree structure of the price process of

the risly asset is shown below.

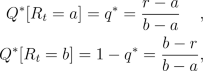

- Explain why a probability

measure Q such that at

any time t the return rate of the risky asset, R,

satisifes Q(Rt=b)=q and Q(Rt=a)=1-q

and Rt+1,Rt

are independent, is equivalent to P if and only if q

is strictly between 0 and 1.

- Suppose that your time horizon

is T=1 and that Q*

is a measure. Prove that the discounted price process is a martingale

under Q* if and only if at

any time t the return rate of the risky asset R

satisifes Q*(Rt=b)=(r-a)/(b-a)

and Q*(Rt=a)=(b-r)/(b-a).

- Extend the previous reasoning

to an arbitrary time horizon T.

Hint: The discounted price process X is a

maritngale under Q* if and

only if for any time t greater than 0, EQ*[Xt|Xt-1=x]=x.

- Explain why this CRR model is

arbitrage free if and only if a

< r < b. In this case the only risk neutral

measure is given by

for

any time t.

Hint: Recall that the probability of an event

must

be a number between 0 and 1.

- What happens if p=0

or p=1?

- Verify the result given in d)

for the Examples given in the previous

lessons.

Important note: The justification of

each of the steps above does not have to be necessarily formal. A more

formal justification would require some background in mathematical

proofs and abstract concepts of probability which are out of the scope

of these lessons. However, the statement and consequences of the First

Fundamental Theorem of Asset Pricing should become clear after facing

these problems.