Massive

short-selling is a practice that is often observed after the burst of a

price

bubble. Examples are the Dutch Tulip-mania in the seventeenth

century, the U.S. stock price crash in 1929, the NASDAQ price bubble of

1998-2000 and more recently the housing price bubble. Since the

practice of short-selling is alleged to magnify the decline of asset

prices, it has been banned and restricted many times during history. As

such, short-selling bans have been commonly used as a regulatory

measure to stabilize prices during downturns in the economy. The most

recent example was in September of 2008 with the prohibition of

short-selling by the U.S. Securities and Exchange Commission (SEC) for

799 financial companies in an effort to stabilize those companies. At

the same time the U.K. Financial Services Authority (FSA) prohibited

short selling for 32 financial companies. On September 22, Australia

enacted even more extensive measures with a total ban of short selling.

However, short-selling prohibition is not only seen after the burst of

a price bubble. In certain cases, the inability to short-sell is

inherent to the specific market. In the housing market, for example,

primary securities such as mortgages cannot be sold short. Additionally

in some of the developed markets and most of the emerging markets

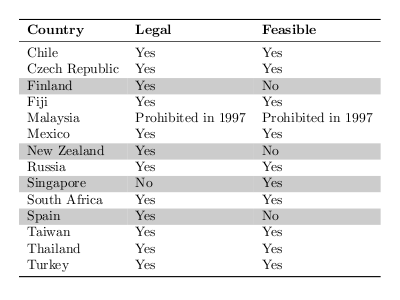

around the world short-selling securities is not feasible. In the table

below we highlighted, as of 2005, the developed markets were

short-selling is not feasible or illegal and listed the emerging

markets where short-selling is feasible. Also, in most of the examples

presented so far, the ability to short-sell the risky assets is crucial

in our arguments. In this section we will state the fundamental theorem

of asset pricing when the risky asset in the model cannot be sold short

and explore some of its consequences. In particular, we will see that

in this case the market is no longer complete.

Example: Dollar Vs Euro with short-selling

prohibition

The arbitrage opportunity presented in example 2 of

lesson

1 involves short-selling the Euro. Recall that in this

example the dollar's interest rate is 10% and the possible rates of

return of the risky asset are

d=-0.2 and

u=0.1.

Suppose now that the Euro cannot be sold short. One might ask then,

does there exist an arbitrage opportunity in

this market that does not sell the Euro short? In order to

answer this question we argue as follows. Suppose that

(x1,y1)

is a trading strategy (see

lesson

2) with nonpositive initial value, i.e.

x1+1.5y1≤0,

and

0≤y1 (this accounts for

the fact that the Euro cannot be sold short). The set of these

strategies can be represented by a cone in the plane (see figure

below). On the other hand the set of strategies that yield nonnegative

outcomes under both states of the world corresponds to strategies

(x1,y1),

such that

1.1x1+1.65y1≥0

and

1.1x1+1.2y1≥0.

These strategies can be represented by a cone in the plane as well (see

figure below).

The intersection of these cones is the strategy (0,0) which is not an

arbitrage opportunity (no strictly positive profit with positive

probability). We conclude then that prohibiting short-selling the Euro

makes this market arbitrage free.

Activity 1

- Consider example 3 of lesson

2 with time horizon equal to T=1. Arguing

as above, prove that if short-selling the GM stock is not allowed then

the market is arbitrage free.

- Can you find conditions on the

dollar's interest rate r

under which the market of part a) remains arbitrage free?

When

the

conditional

expectation under a probability

Q of a

process at a future time is less than or equal its present value, the

probability

Q is called a

supermartingale

measure. If the conditional expectation of the process at a

future time is greater than or equal its present value, the probability

Q is called a

submartingale

measure. A probability that is a supermartingale and a

submartingale measure simultaneously is a

martingale

measure.