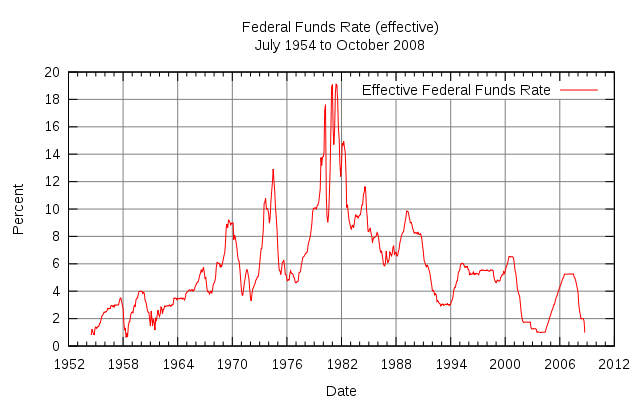

The federal fund

rate is the interest rate at which depository institutions

(typically banks) lend money to other depository institutions over

night. With the aim at regulating the supply of money in the U.S.

economy, the Federal Open Market Committee (FOMC) periodically sets a

target for the federal fund rate, which is then determined by open

market.

In the

multi-period

model considered in module 1 we assumed that the interest

rate

r and the rates of return

d

and

u were constant over time. When trading bonds,

the main source of risk in the market comes from the changes over time

on the spot interest rate

r, and hence is not very

accurate to assume this rate to be constant over time. Over long

periods of time, even in the stock market, the assumption of constant

interest rates might be too restrictive (the figure below shows the

federal fund rates between July of 1954 and October of 2008, see

tangent). Additionally, when looking at price movements in the stock

market it becomes clear that the rates of return over time can not be

modeled by just using the two variables d and u. In the present lesson

we will restate the fundamental theorem of asset pricing for time

dependent interest rates and rates of return. This extension appears to

be very simple by it turns out to be very useful, since more robust

models can be used in this framework.

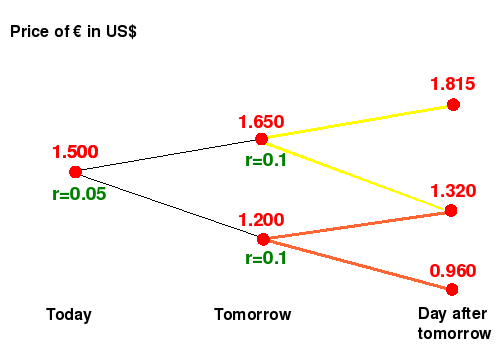

Example: Dollar

Vs Euro with time dependent interest rate

Suppose that

the exchange rate of the Euro against the dollar is as in the

multi-period model presented in

lesson

1. Assume that today the interest rate on the Dollar is 5%,

but tomorrow it changes to 10% (see figure below). Assume further that

the interest rate on the Euro is 0% for the next two days. By the

considerations made in module 1 we know that this model is arbitrage

free for the first period of time. One might ask then:

is this model, in which interest rates on

the dollar depend on time, arbitrage free over the two days time

horizon as well?

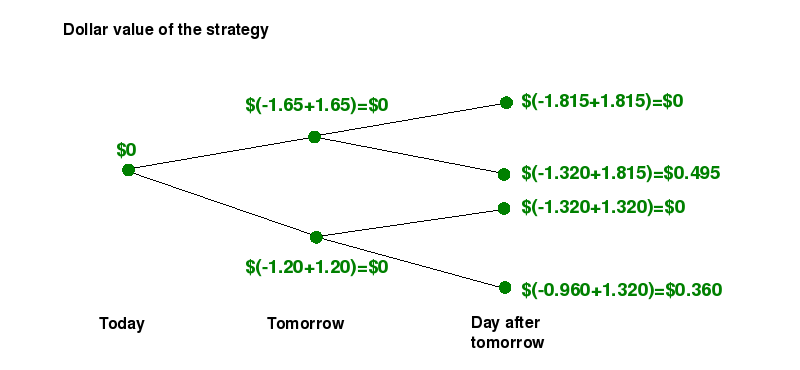

The answer to

this question is negative because the interest rate in the second

period is not strictly between the rates of return

u=0.1

and

d=-0.2. An example of an arbitrage opportunity

is the following: do not trade today, wait until tomorrow to

short-sell

€1 and lend the selling price in dollars. This strategy represents an

arbitrage opportunity, the value of the strategy at different times is

given in the diagram below.

This example

illustrates the following fact: a

market model is arbitrage free if and only if every one step submodel

is arbitrage free as well. In the case above, the one-step

submodels obtained when the price goes either up or down

(highlighted with yellow and orange in the figure above) are not

arbitrage free and neither is the two-step model.

Activity

1

-

Suppose that the stock's price of General Motors is as in lesson

2. Assume that the dollar's interest rate today is 0%, but

tomorrow it is 1%. Determine if this market is arbitrage free. In case

it is not, give an example of an arbitrage opportunity.

- Suppose now that the stock pays

1% of dividend on each dollar invested

between tomorrow and the day after tomorrow (see lesson

7). Is in this case the market arbitrage free?

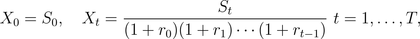

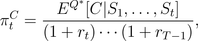

The Fundamental

Theorem for time dependent interest rates and rates of return

As we already

mentioned above in order to guarantee the nonexistence of an arbitrage

opportunity in a multi-step model it is necessary and sufficient to

guarantee the arbitrage free condition over the one-step submodels.

This results applies not only when interest rates change over time, as

we saw in the example presented above, but also when the rates of

return on the risky asset are time dependent as well. In general, if we

have a model with a riskless asset with time

dependent interest rate rt

and price process St0=(1+rt)t,

and a risky asset with time

dependent rates of return, dt<

ut, each of which can be realized at

any time with positive probability, and price process St,

the market is arbitrage-free if and only if at any time t

which holds if

and only if the discounted price process

is a

martingale

with respect to the risk

neutral probability, that at each time t gives the

probability (rt-dt)/(ut-dt)

to the realization of the rate of return ut.

A natural generalization of this result can be obtained for multi-asset

markets (see

lesson

8).

The statement of this

generalizatation is left as an exercise for the reader.

Also notice that the result above allows us to study models in which

dividend payments on the risky asset are not paid at each time (see

lesson

7). For instance assume that in the example above the

interest rate on the Euro is 0% today but 10% tomorrow. This pushes up

the rates of return on the Euro tomorrow, from

d1=-0.2

and

u1=0.1, to

d'1=-0.12u'1=0.21

(see

lesson

7). Therefore the arbitrage condition of the fundamental

theorem is satisfied and the model is arbitrage free (observe that the

strategy exhibited above is no longer an arbitrage opportunity under

this circumstances).

Activity

2

- Verify your answer in part b)

of activity 1 by using the fundamental

theorem for time dependent interest rates and rates of return.

- Generalize the fundamental

theorem for time dependent interest rates

and rates of return, when there is more than one risky asset in the

market (see lesson

8).

Pricing

European type claims

The theorem

stated above also reveals how to price contingent claims in models with

time dependent interest rate and rates of return. According to the

fundamental theorem, the price at time t of a

contingent claim with payoff CT

at maturity time T is equal to

where

Q*

is the probability, that at each time

t gives the

probability

(rt-dt)/(ut-dt)

to the realization of the rate of return

ut.

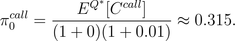

For instance, suppose that the stock of GM behaves as in

lesson

2, the interest rate over time is given by

r0=0

and

r1=0.01. Assume further

that GM pays $1.01 for each dollar invested in the stock between

tomorrow and the day after tomorrow. In this case the rates of return

are

d0=-0.03,

u0=0.01,

d1=-0.0203 and

u1=0.0201

(see

lesson

7). The risk neutral probabilities of the high rates of

return today and tomorrow are

(0+0.03)/(0.01+0.03)=0.75

and

(0.01+0.0203)/(0.0201+0.0203)=0.75,

respectively. In this case the price today of a

European

call option with maturity the day after tomorrow and strike

10*0.97

is

Activity

3

-

Find the prices tomorrow of the call option described above (see lesson

8).

- Consider the same model as in

the example above. Find today's price of

a straddle

on the GM stock.